Every business owner knows the quiet satisfaction of sending out an invoice. It’s the reward for hard work delivered and a promise of income to come. But what happens when that payment never arrives? That lingering unpaid invoice isn’t just an inconvenience—it’s a potential bad debt, and it can quietly erode your cash flow, profitability, and peace of mind.

In simple terms, a bad debt is money owed by a customer that will never be paid, either because they can’t or won’t. You may have to write it off in your accounts, absorbing it as a loss. And that’s a hit no growing business wants to take.

In this guide, we’ll uncover why bad debts happen, how smart businesses prevent them, and what to do when things go wrong. If you’re looking to protect your business finances, reduce risk, and improve cash flow, this is for you.

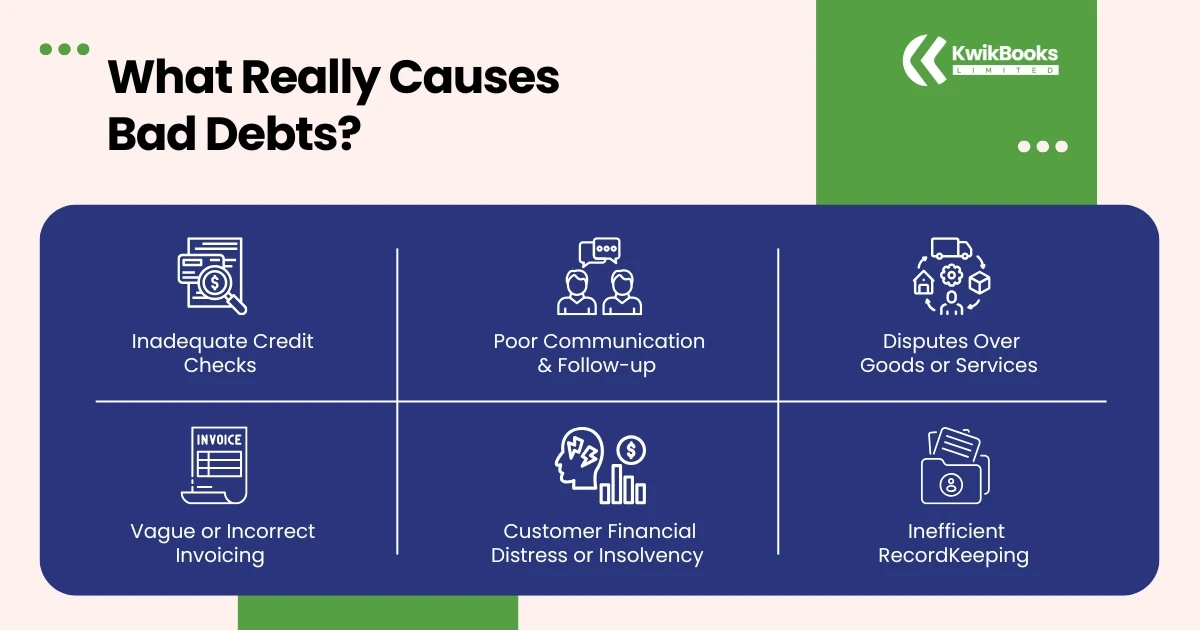

Understanding the root causes of bad debts is the first step in building your defence.

It’s tempting to welcome every sale with open arms, especially when you’re starting out. But extending credit without checking a customer’s payment history or financial health is like offering a parachute you’ve never tested. Credit reference agencies like Experian or Equifax can provide insight into a customer’s reliability—use them.

Invoices are legal documents, and even small errors can lead to delays or disputes. Missing purchase order numbers, incorrect amounts, or vague descriptions all give customers an excuse to delay payment. Your invoice should be crystal clear—lay out what you provided, when, how much it costs, and when it’s due.

If you’re not chasing invoices promptly, you may be sending the wrong message—that getting paid isn’t urgent. Many businesses fail here simply because they don’t have a structured follow-up system.

Sometimes, even the best customers run into trouble. A sudden downturn, supply chain crisis, or internal mismanagement could leave your client unable to pay—or worse, in administration. These cases are unfortunately common and often out of your control.

If your customer is unhappy with the product or service, they might use payment as leverage. Disputes—no matter how minor—can stall cash flow for weeks or even months. Clear contracts, honest communication, and quick resolution are essential.

Can’t find that invoice? Don’t know who’s paid and who hasn’t? You’re not alone. Poor records lead to missed follow-ups, duplicated invoices, or even forgotten payments. This is where professional bookkeeping can make a dramatic difference.

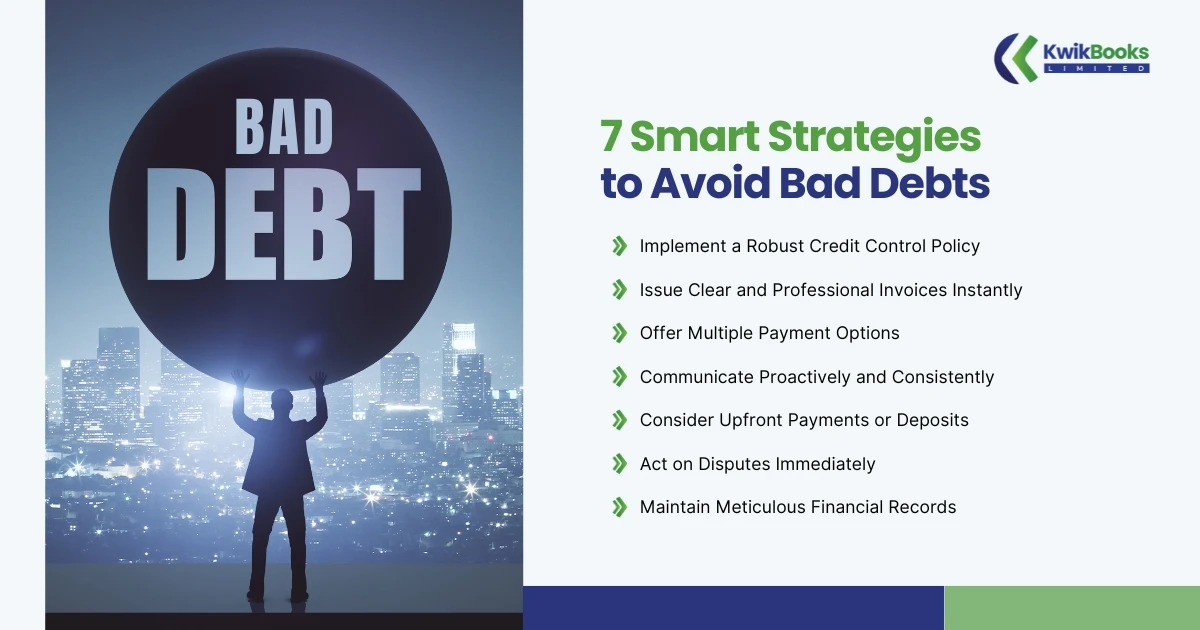

It’s not enough to react—you need to plan ahead. These proven strategies will help you stay one step ahead of bad debts.

Think of this as your credit playbook. Define:

Make use of UK credit reference agencies to assess new clients before extending credit. Prevention is always cheaper than cure.

Send invoices immediately after completing a job. A professional invoice should include:

The easier it is to pay you, the faster you’ll get paid. Accept:

Don’t lose money because someone couldn’t pay their preferred way.

A simple reminder before the due date often prevents delay. After that:

Consistency shows professionalism and urgency.

Especially for large orders or new clients, request a deposit. It secures commitment, improves cash flow, and protects you if the relationship sours.

Never let complaints sit unanswered. Respond quickly, document everything, and resolve the issue to unlock payment. Ignored disputes often turn into bad debts.

Accurate books allow you to spot slow payers before they become no-payers.

Even the most diligent business faces the occasional bad debt. Accounting for it properly is key.

A bad debt provision (also known as an allowance for doubtful debts) is an amount set aside in your books to cover debts that may not be collected.

It’s not a random guess—it’s an informed estimate based on past experience or specific customer risk.

In the UK, this is crucial for two reasons:

Sometimes, despite best efforts, a debt becomes irrecoverable.

Once you’re sure the debt won’t be paid (e.g., after 90–120 days of no response), write it off. This means:

If you’ve already paid VAT on the invoice to HMRC, you may be eligible to reclaim it.

Learn more about VAT Bad Debt Relief on GOV.UK →

Managing credit, chasing payments, and tracking your finances takes time—time you’d rather spend growing your business.

At Kwikbooks, we do more than balance your books. We build proactive systems that prevent bad debts before they happen. From accurate invoicing and credit control to tracking slow payers and ensuring HMRC compliance, we’ve got your back.

Discover Our Bookkeeping Packages

Bad debts don’t just happen—they’re usually preventable. With clear systems, consistent follow-up, and smart bookkeeping, you can significantly reduce your risk.

Remember: prevention beats collection. Be proactive, and your cash flow will thank you.

While there's no legal rule, many businesses consider writing off debts after 90–120 days. However, to reclaim VAT, the invoice must be at least 6 months overdue and written off in your accounts.

A doubtful debt is one you suspect may not be paid. A bad debt is confirmed as uncollectible and has been formally written off.

Yes. Debt collection agencies are commonly used as a last resort. They charge either a fixed fee or a percentage of the recovered debt.

Stay updated with expert bookkeeping tips and insights! Subscribe now to receive updates directly in your inbox for your business.

* We never spam your email

KwikBooks Limited 1 Hadley Court, 223 Ballards Lane, London, N3 1NB,

Monday - Friday 09:30 AM - 05:30 PM

© 2026 All Rights Reserved.