For many business owners, payroll is both essential and stressful. It’s not just about paying staff on time it’s about navigating an intricate web of HMRC rules, tax codes, pension schemes, and compliance requirements. Even the smallest payroll error can lead to severe consequences such as HMRC fines, unhappy employees, reputational damage, and increased operational costs.

Yet, despite its importance, payroll mistakes remain one of the most common challenges faced by UK businesses particularly SMEs that often lack the resources to maintain an in-house payroll team.

The solution? Payroll outsourcing. By shifting responsibility to professional providers, businesses can access expertise, secure systems, and peace of mind while reducing the risk of errors.

This blog explores the most common payroll mistakes UK businesses make, how outsourced payroll services can help avoid them, the payroll outsourcing cost, and what to look for when choosing the right partner.

Payroll errors can feel small at first glance, but their ripple effects are wide-reaching. Below are the top 10 costly mistakes that outsourcing can prevent.

One of the most frequent issues arises from confusing contractors with employees.

Assigning the wrong tax code can cause employees to either overpay or underpay tax.

PAYE deadlines are non-negotiable.

Calculating holiday pay, especially for irregular hours or zero-hour contracts, is complex.

UK businesses are legally required to keep payroll records for at least three years.

The National Minimum Wage is updated annually.

Auto-enrolment is often mishandled.

Employers must handle various statutory payments including SSP (Statutory Sick Pay) and SMP (Statutory Maternity Pay).

Payroll records include highly sensitive personal and financial data.

Lack of communication around payslips, deductions, and benefits creates unnecessary disputes.

This is where outsourced payroll providers UK can step in. By leveraging expertise, technology, and compliance knowledge, they can transform a stressful process into a seamless one.

Payroll outsourcing ensures access to specialists who keep up with the latest HMRC rules. Instead of worrying about constant updates, businesses can trust experts to stay compliant on their behalf.

With automation and professional oversight, outsourced teams prevent late submissions, incorrect tax codes, and other common errors. This protects businesses from fines and improves employee trust.

Running payroll in-house involves salaries, payroll software, ongoing training, and compliance management. Payroll outsourcing fees are often lower, making it a cost-effective choice.

Professional payroll outsourcing UK providers invest heavily in data encryption, secure portals, and GDPR compliance. This reduces the risk of breaches and protects both employers and employees.

As a business grows, payroll becomes more complex. Outsourced services scale easily to handle additional employees, new benefits, and evolving compliance requirements.

Modern payroll providers offer employee self-service portals, cloud-based dashboards, and mobile-friendly tools. These features enhance efficiency and transparency.

Perhaps the biggest benefit is peace of mind. Business owners can focus on core growth activities without worrying about missed deadlines or compliance issues.

A frequent question business owners ask is: how much does it cost to outsource payroll?

At KwikBooks, we offer transparent pricing, ensuring businesses know exactly what they’re paying for.

outsourcing is often more affordable for SMEs.

Request your payroll outsourcing quote today.

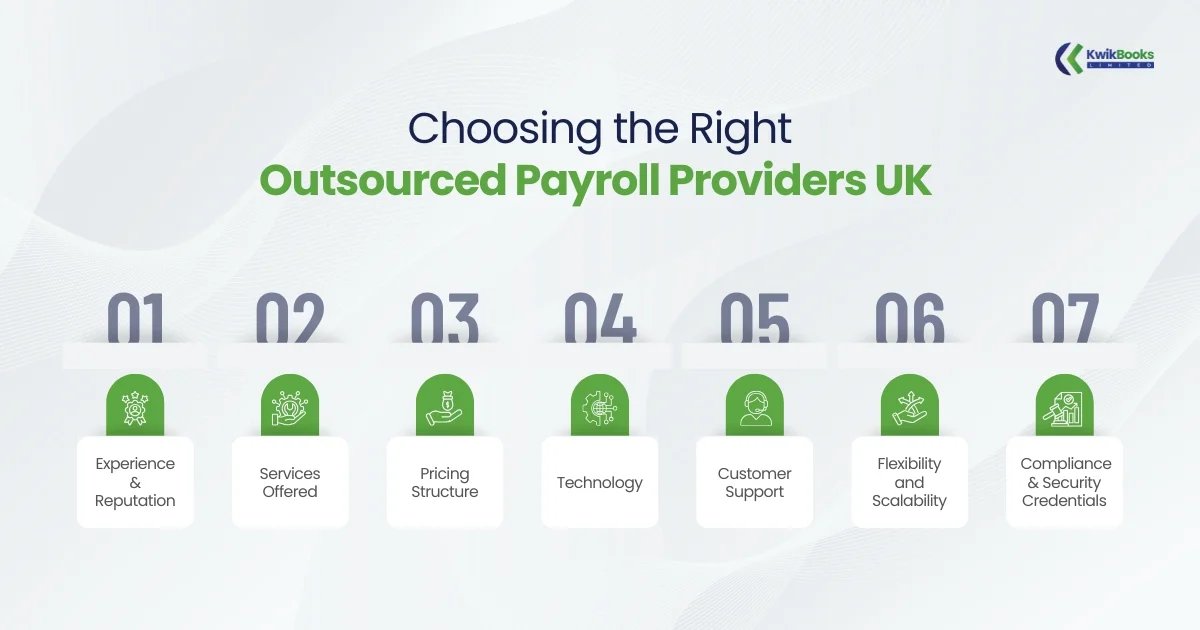

Not all providers are created equal, and choosing the wrong partner can lead to more problems than solutions. When outsourcing something as sensitive as payroll, businesses must take a careful, strategic approach. Here are the key factors to evaluate before making your decision:

Look for established outsourced payroll providers UK with a proven track record. Experienced firms understand the complexities of HMRC regulations and the common pitfalls SMEs face. Reading client testimonials, online reviews, and detailed case studies can give you confidence in their ability to deliver accurate and compliant services. A provider with years of experience across industries will often anticipate challenges and resolve them before they become costly mistakes.

Not every provider delivers the same scope of services. Some offer basic payroll processing only, while others include additional support such as pension management, auto-enrolment, HR advisory services, and compliance checks. Before signing a contract, think carefully about your long-term needs. For instance, a fast-growing company may require a provider that can support more complex needs like employee benefits, statutory payments, or international payroll.

One of the main advantages of payroll outsourcing is cost savings, but pricing transparency is essential. Ask potential providers to outline all their fees in detail. The best partners avoid hidden charges and use a clear pricing model often based on the number of employees or payslips processed. Comparing payroll outsourcing fees to the true cost of in-house payroll (staff salaries, software licenses, training, and fines) will help you see the real value.

Payroll today is powered by technology. A reliable provider should use modern, secure, and user-friendly payroll software that integrates seamlessly with your business systems. Features like employee self-service portals, mobile access, and real-time reporting not only make payroll more efficient but also improve transparency for staff. It’s also important to ensure the provider’s systems meet GDPR and HMRC requirements for data security and compliance.

Even with the best technology, issues may arise. That’s why customer support is a critical consideration. Ask:

A responsive and knowledgeable support team ensures that problems are resolved quickly, avoiding disruptions for your employees.

As your business evolves, so will your payroll requirements. A strong payroll partner should be able to scale services up or down, whether you’re hiring rapidly, adding new benefit structures, or adjusting to seasonal staff changes. This flexibility prevents you from outgrowing your provider too quickly.

Finally, ensure the provider has a strong compliance framework. Ask about data security measures, certifications, and compliance audits. Payroll data is highly sensitive, and GDPR penalties for breaches are steep. A trustworthy provider will have clear policies in place to protect your business and your employees.

By carefully weighing these factors, you can select a payroll partner who not only manages compliance but also adds value to your business operations.

For additional guidance, you can also refer to HMRC guidance on running payroll.

Payroll is one of the most important functions within any organisation, and yet it is also one of the easiest areas for costly mistakes to occur. From tax code errors and missed HMRC deadlines to pension enrolment oversights and data security risks, the consequences of getting payroll wrong can be significant. Not only do these mistakes result in financial penalties, but they can also damage employee morale and harm your business reputation.

By outsourcing payroll to a trusted partner, businesses gain the assurance that every calculation, submission, and compliance requirement is handled by experts. This means fewer errors, stronger security, and more time to focus on growing your company. For many SMEs, the cost of outsourcing is far more affordable than running payroll in-house.

At KwikBooks, we provide reliable, transparent, and professional payroll outsourcing services tailored to UK businesses.

Stay updated with expert bookkeeping tips and insights! Subscribe now to receive updates directly in your inbox for your business.

* We never spam your email

KwikBooks Limited 1 Hadley Court, 223 Ballards Lane, London, N3 1NB,

Monday - Friday 09:30 AM - 05:30 PM

© 2026 All Rights Reserved.