In today’s competitive economy, UK businesses are constantly seeking ways to reduce costs without compromising on quality. One of the most effective, and increasingly popular, solutions is offshore bookkeeping. By working with professionals outside the country, businesses can streamline financial operations, maintain compliance, and access expert support at a fraction of local costs.

This guide explores what offshore bookkeeping is, why it’s worth considering, how to get started, and how trusted providers like KwikBooks are transforming the way UK businesses manage their books.

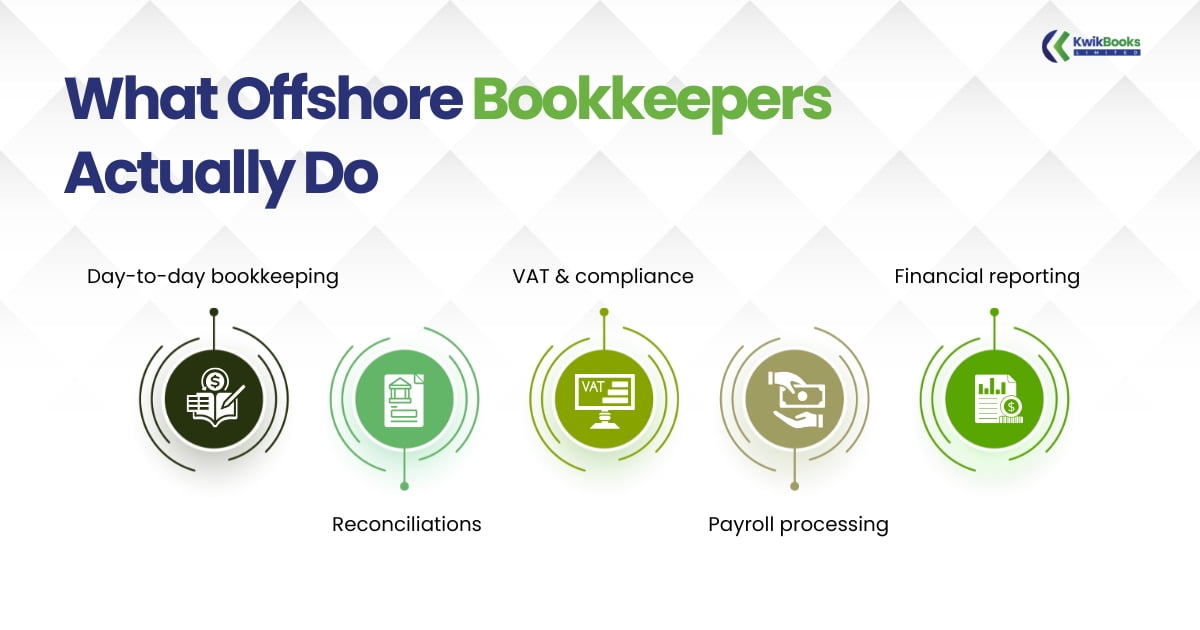

Offshore bookkeeping refers to the practice of outsourcing bookkeeping services to professionals or firms based in other countries. These offshore partners handle core financial tasks such as:

Modern offshore bookkeepers are well-versed in UK standards and use cloud-based tools like Xero, QuickBooks, and Sage, making collaboration seamless and secure. By tapping into this global talent pool, UK businesses gain cost-effective, reliable, and scalable bookkeeping support.

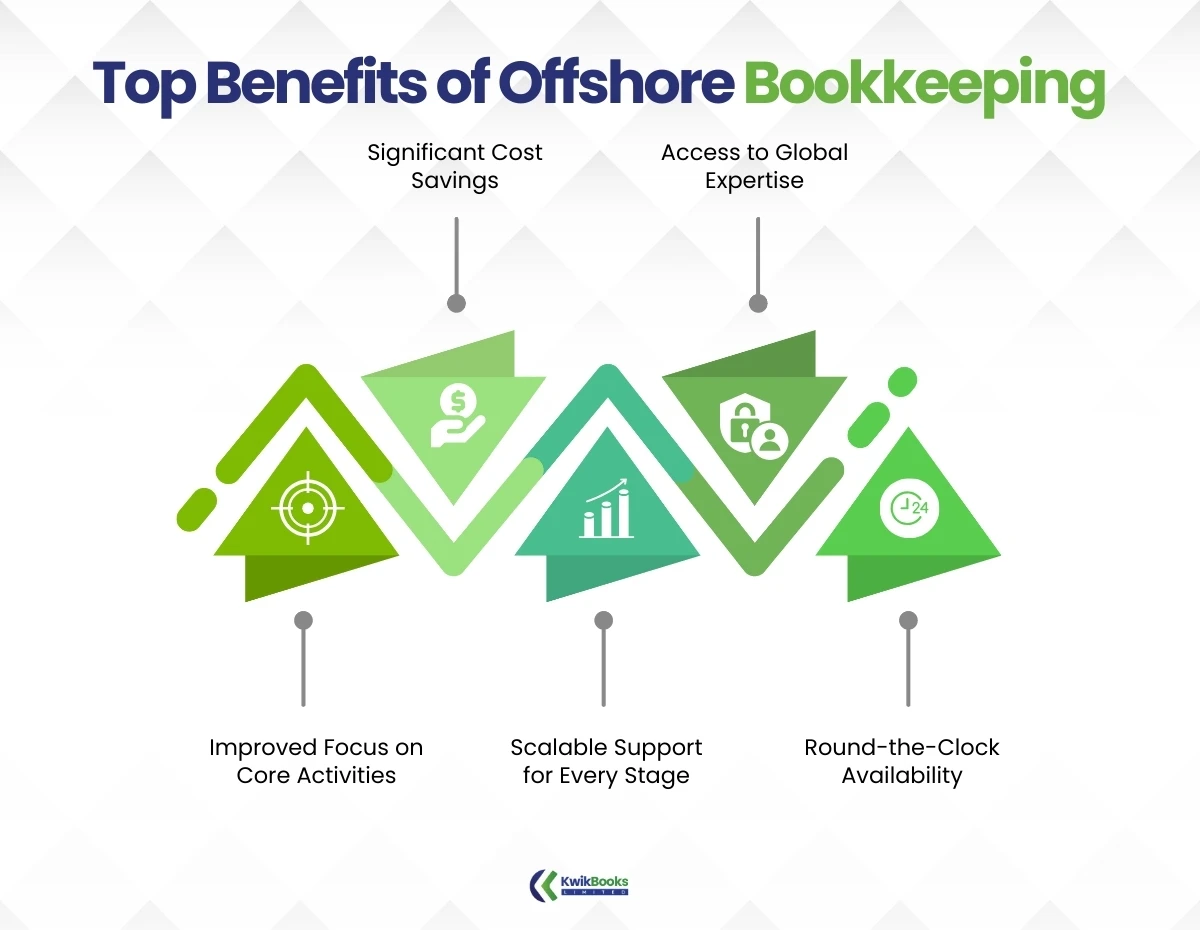

For many business owners and finance teams, the question isn’t just what is offshore bookkeeping, it’s why offshore bookkeeping is rapidly gaining popularity. Here are some compelling reasons:

Hiring in-house bookkeepers or local firms in the UK can be expensive due to higher salaries, payroll taxes, and overheads. Offshore bookkeeping services often cost up to 60% less, offering a clear path to improved profit margins.

Offshore professionals are trained in international accounting standards and are often experienced in UK tax laws, HMRC regulations, and reporting requirements.

Delegating financial admin tasks allows business owners to focus on strategy, growth, and customer service, while bookkeepers handle the numbers behind the scenes.

Whether you’re a start-up, growing SME, or established enterprise, offshore bookkeeping solutions are flexible enough to adapt to your evolving needs.

With teams operating across time zones, many offshore providers offer quicker turnaround and extended service coverage, especially during deadlines and month-end closing.

A common misconception is that offshore bookkeepers are only useful for basic data entry. In reality, they offer a broad range of services that match, and often exceed the capabilities of local hires:

With cloud accounting software, you retain full visibility and control while your offshore team works behind the scenes.

Offshoring can raise valid concerns around security, communication, and oversight. Here’s how to tackle them:

Choose providers who offer UK-friendly hours or dedicated account managers. Scheduled check-ins, weekly updates, and clear workflows minimise gaps.

Ensure your offshore partner complies with GDPR and uses encrypted platforms. NDAs and secure login protocols add extra layers of protection.

Work with providers who have experience with UK businesses and can provide references or case studies. Start with a trial phase to assess performance.

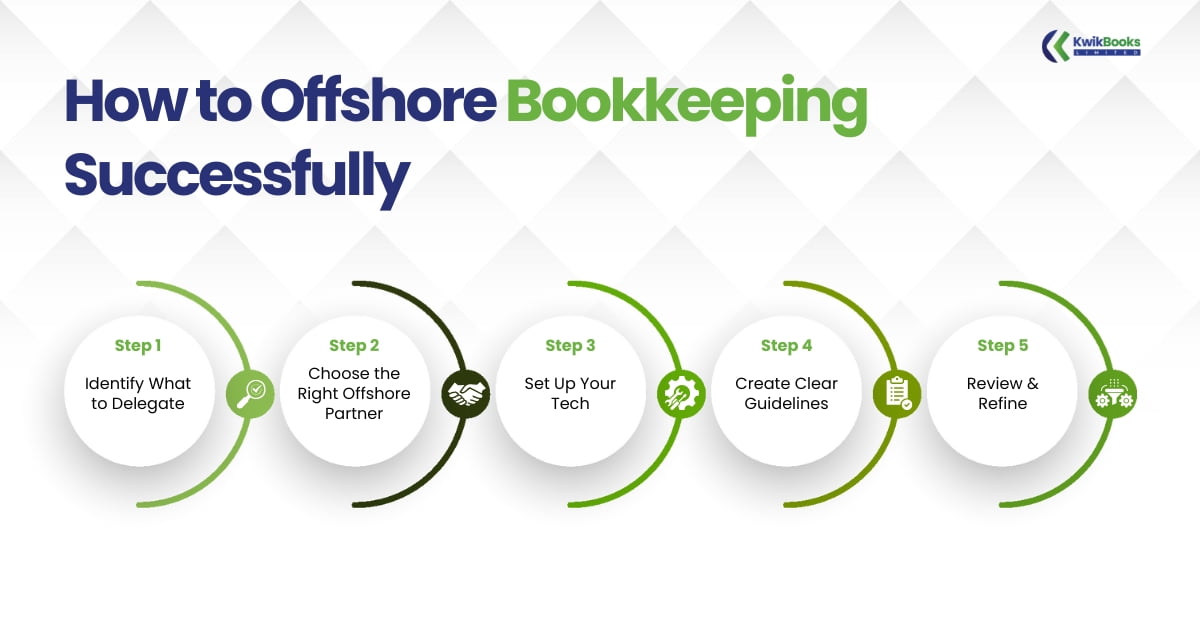

Making the shift to offshore doesn’t have to be complicated. Here’s a simple roadmap:

Making the shift to offshore doesn’t have to be complicated. Here’s a simple roadmap:

Start by listing bookkeeping tasks that consume the most time or require accuracy e.g., bank reconciliations, VAT returns, or payroll.

Look for providers with a track record of serving UK clients, knowledge of local regulations, and secure working methods.

Use cloud accounting tools like Xero or QuickBooks. Ensure your offshore bookkeeper has appropriate access and training.

Set expectations around deadlines, formats, communication preferences, and escalation processes.

Monitor progress regularly. A good offshore arrangement is built on continuous feedback, adjustment, and mutual trust.

At KwikBooks, we specialise in providing tailored offshore bookkeeping services to businesses across the United Kingdom. We don’t just manage your books, we become your remote financial partner.

Our team understands UK bookkeeping requirements, VAT, payroll, and compliance ensuring accurate, timely, and regulation-ready work.

We offer fixed monthly packages and flexible plans, so you only pay for what you need.

All systems are GDPR-compliant and use encrypted access, ensuring your financial data remains confidential and protected.

Every client is paired with a dedicated account manager who provides regular updates, advice, and a point of contact you can rely on.

Whether you use Xero, QuickBooks, Sage, or Zoho, our team integrates smoothly into your workflow, keeping your books up to date, wherever you are.

From startups to accountants looking to outsource the backend, KwikBooks helps you save time, reduce costs, and gain peace of mind.

If accuracy, affordability, and flexibility matter to you, offshore bookkeeping could be your best move.

Bookkeeping is the financial backbone of your business. But managing it in-house can be expensive and time-consuming. With offshore bookkeepers, you can maintain financial clarity, reduce stress, and save on operational costs, all without compromising on quality.

And when it comes to finding the right partner, KwikBooks delivers personalised, secure, and UK-compliant offshore bookkeeping solutions that help you thrive.

Stay updated with expert bookkeeping tips and insights! Subscribe now to receive updates directly in your inbox for your business.

* We never spam your email

KwikBooks Limited 1 Hadley Court, 223 Ballards Lane, London, N3 1NB,

Monday - Friday 09:30 AM - 05:30 PM

© 2026 All Rights Reserved.