Bookkeeping isn’t just about managing numbers; it’s about maintaining trust, clarity, and open communication between a business owner and their bookkeeper. For many small and medium‑sized businesses (SMBs), the difference between financial success and confusion often comes down to how effectively they communicate with their bookkeeping partner.

In this blog, you’ll discover what to expect from a professional bookkeeper, the key questions to ask, and how KwikBooks, a trusted UK‑based bookkeeping and accounting firm, bridges communication gaps to deliver timely, transparent, and reliable financial results.

Your bookkeeper isn’t only logging transactions. They’re reconciling accounts, managing invoices and payments, handling payroll, preparing VAT returns, and maintaining your financial records. Without clear communication, even small misunderstandings can lead to misfiled data, cash‑flow issues, or reporting delays.

Communication breakdowns can cause inconsistencies in how income, expenses, or VAT are recorded, leading to inaccuracies in your reports and potential non‑compliance. When expectations, assumptions, and categorization are clarified in advance, financial data becomes more accurate and meaningful.

Strong communication transforms a bookkeeper from a service provider into a trusted business partner. When you understand your numbers and your bookkeeper understands your goals, you gain a shared sense of control and direction that helps your business grow with confidence.

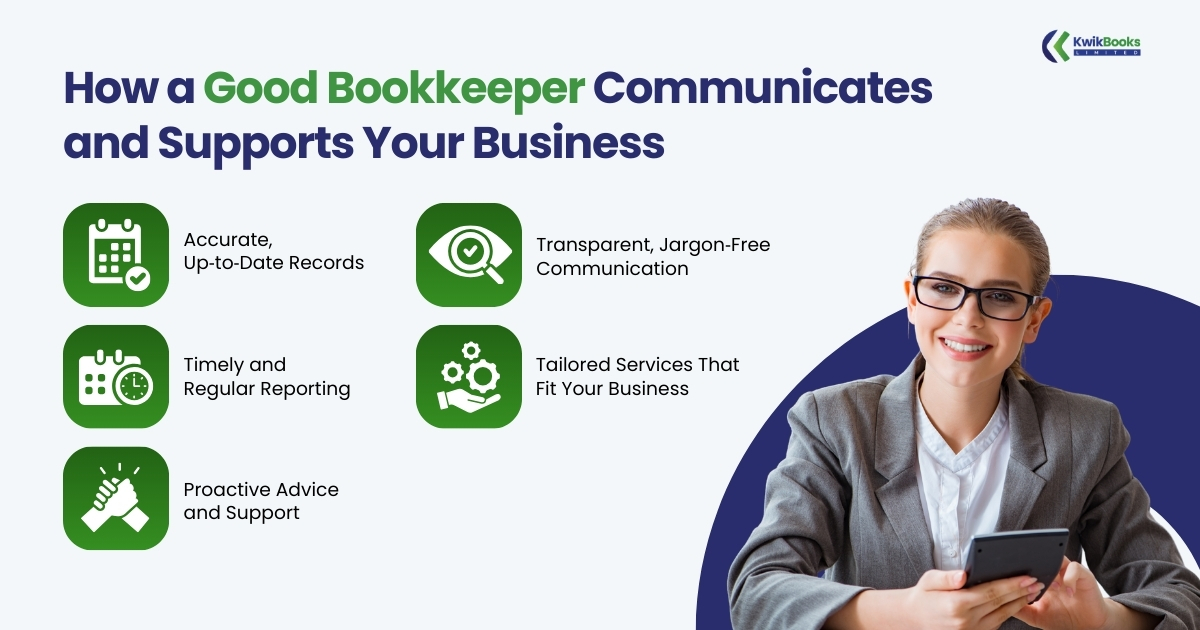

Expect your bookkeeper to keep every transaction organized and categorized properly. From bank reconciliations and payroll to VAT submissions, accurate and current records form the foundation of sound business decisions.

A professional bookkeeper should deliver monthly or quarterly reports, including profit and loss statements, balance sheets, and cash‑flow summaries, so you always know your financial position.

A reliable bookkeeper explains your financial data in clear, simple language. They communicate regularly, clarify any assumptions, and provide context so you can make informed decisions without confusion.

A bookkeeper should adapt to your business model, whether you are managing seasonal sales, inventory, or service‑based income. They should also integrate seamlessly with your accounting software and provide easy access to reports and documents.

Good bookkeepers go beyond balancing the books. They offer insight into improving cash flow, managing VAT efficiently, preparing for tax submissions, and helping you identify opportunities for growth or savings.

Choosing a reliable UK-based bookkeeping and accounting firm like KwikBooks transforms bookkeeping from a slow, back-and-forth process into a clear, proactive, and collaborative financial experience for small and medium-sized businesses.

KwikBooks provides accurate and timely bookkeeping services that include bank reconciliations, accounts payable and receivable, payroll management, VAT returns and submissions, and detailed management reporting.

The team follows a structured communication approach that ensures clients are always informed about what’s happening, when, and why.

By maintaining precise records, regularly reconciling accounts, and providing proactive updates on outstanding invoices, payroll schedules, or VAT deadlines, KwikBooks helps prevent confusion and miscommunication. This approach ensures that financial communication remains smooth, consistent, and effective.

KwikBooks delivers clear, easy-to-understand management reports that offer real-time insights into your business’s financial performance. From profitability trends to VAT liabilities, these reports provide actionable information in a format that is accessible and free of jargon.

Unlike automated platforms, KwikBooks provides a hands-on, relationship-focused service. Their UK-based professionals tailor bookkeeping and accounting support to match the specific needs of each client, whether you’re a sole trader or a limited company, while ensuring full compliance with UK accounting standards and HMRC regulations.

KwikBooks operates with a transparent workflow that documents every step, from bank reconciliations to VAT submissions, so clients always have visibility into their financial activities.

Their responsive communication ensures clients receive timely answers and updates. With KwikBooks, you gain accuracy, reliability, and financial support that empower better decision-making and long-term business success.

Watch for these signs that your bookkeeping relationship needs attention:

Bookkeeping isn’t just about record keeping; it’s about maintaining financial clarity, compliance, and trust. When business owners and bookkeepers communicate effectively, reports stay accurate, taxes stay compliant, and growth stays on track.

Partnering with KwikBooks gives UK SMBs the best of both worlds: expert bookkeeping and accounting services backed by clear communication, real-time updates, and a client-first approach.

Stay informed, stay compliant, and build a stronger financial foundation, because when it comes to bookkeeping, communication is the key to confidence and success.

If you notice these, it may be time to reassess your bookkeeping provider or switch to a proactive, transparent service like KwikBooks.

Stay updated with expert bookkeeping tips and insights! Subscribe now to receive updates directly in your inbox for your business.

* We never spam your email

KwikBooks Limited 1 Hadley Court, 223 Ballards Lane, London, N3 1NB,

Monday - Friday 09:30 AM - 05:30 PM

© 2026 All Rights Reserved.