As a business owner, you know that filing VAT returns is a crucial, yet often stressful, task. Especially during peak times, when you’re already juggling many responsibilities, the pressure can mount, and mistakes are more likely to occur. But it doesn’t have to be that way. VAT outsourcing provides a valuable solution to streamline the process, reduce stress, and ensure compliance with VAT regulations. In this post, we’ll explore how outsourcing VAT services can help you manage your VAT returns more efficiently during peak times and why it’s a smart choice for businesses of all sizes.

VAT returns are an essential part of business management, but they can be challenging, particularly when you’re under time pressure. Many businesses struggle with the complexity of VAT regulations, as well as the administrative burden of keeping track of every transaction and filing accurate returns. This is especially true during busy periods, such as the end of the financial quarter, when businesses often have a lot on their plates.

The UK VAT system is governed by the VAT Act 1994, which outlines all rules and regulations concerning VAT. With frequent updates and changes, it can be difficult for business owners to keep up. For example, with the advent of Making Tax Digital (MTD), businesses are required to keep digital records and submit VAT returns via compatible software. These regulations add another layer of complexity, and failure to comply can result in penalties.

The process becomes even more complicated during peak times, when businesses are handling large volumes of transactions and need to manage their financial records quickly and accurately.

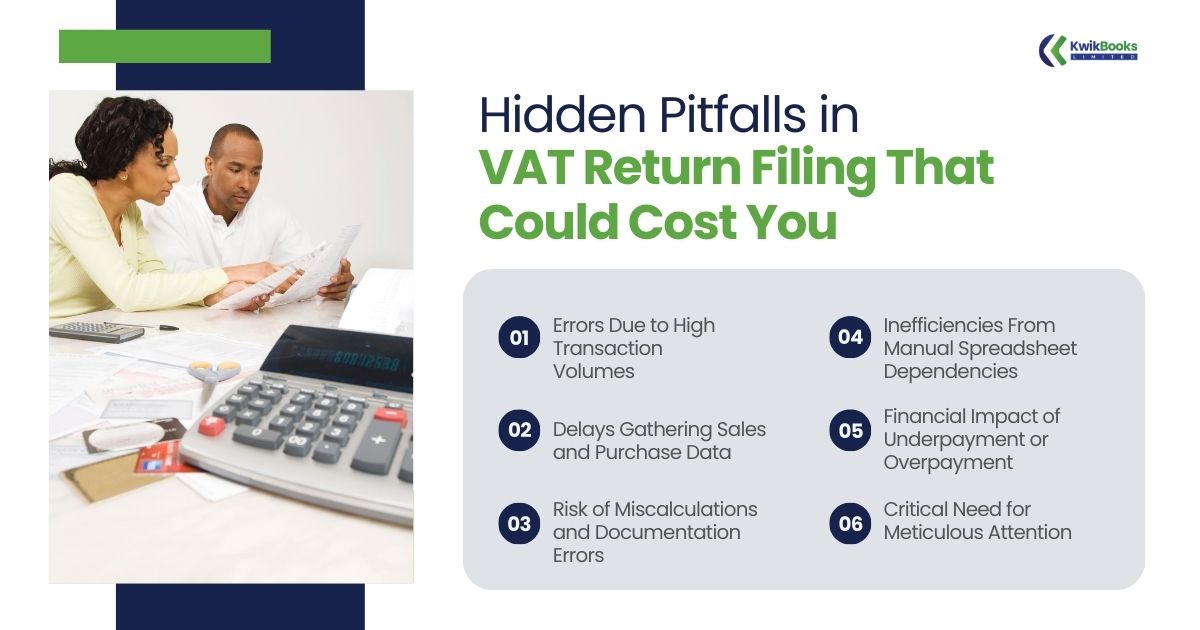

Filing VAT returns involves meticulous attention to detail, and even the smallest mistake can lead to significant problems. Some common challenges that businesses face when filing VAT returns include:

These challenges highlight why many businesses choose to outsource VAT services, particularly when workload surges happen.

VAT outsourcing refers to the practice of hiring external professionals or service providers to manage the VAT filing and compliance process on behalf of your business. This approach not only ensures accuracy and compliance but also helps free up internal resources so you can focus on running and growing your business.

Outsourcing VAT services involves more than just filing your returns. It includes everything from bookkeeping to VAT calculations, ensuring all records are kept up-to-date and accurate. When you outsource VAT services, you gain access to experts who are well-versed in VAT regulations, including any recent updates, ensuring that your business remains compliant at all times.

Outsourcing VAT is especially beneficial during peak periods when your business is under pressure. By relying on external professionals, you can relieve your internal team from the burden of VAT filing, ensuring that your business stays on track without compromising other important tasks.

VAT regulations are complex and constantly changing. Professionals who specialise in VAT outsourcing are always up-to-date with the latest changes to tax laws, ensuring that your business remains compliant with the VAT Act 1994 and any new updates like Making Tax Digital. By outsourcing VAT services, you can ensure your business is always in line with current VAT rules, reducing the risk of costly errors and penalties.

Inaccurate VAT returns can lead to penalties from HMRC. These penalties can add up quickly, leading to financial strain on your business. By outsourcing VAT services to a professional, you’re more likely to file accurate returns, reducing the risk of penalties. Professionals have the experience and expertise to catch potential errors before they become costly mistakes.

The UK government has made it mandatory for businesses above a certain turnover threshold to submit VAT returns using Making Tax Digital compatible software. VAT outsourcing service providers use the latest cloud-based software, ensuring that your business remains compliant with these requirements. This seamless integration reduces the complexity of the filing process and minimises the chance of errors.

One of the most significant benefits of outsourcing VAT services is the time and resource savings. During peak periods, when your team is already busy with other tasks, outsourcing VAT allows your business to focus on growth and operations without being bogged down by administrative tasks. VAT professionals take care of all the filing, documentation, and compliance, freeing up your internal resources for more important business activities.

Outsourcing VAT allows your business to focus on core functions such as sales, marketing, and customer service. You no longer have to worry about tracking every single transaction or managing VAT records manually. With a professional team handling the VAT process, you can rest assured that everything is taken care of and focus on growing your business.

Outsourcing VAT services can be especially beneficial during peak times. Below are some of the ways VAT outsourcing helps businesses navigate the pressures of VAT return deadlines.

When you outsource VAT services, you ensure that your returns are filed quickly and accurately. VAT professionals have the tools and experience to prepare your returns efficiently, ensuring no detail is overlooked. This means that your business can meet its VAT deadlines without the last-minute scramble, reducing stress during peak times.

VAT outsourcing experts ensure that your returns are fully compliant with HMRC regulations. With the help of professionals, your business is less likely to make mistakes that could lead to penalties or fines. This peace of mind is especially valuable during peak times, when the risk of errors is higher.

As your business grows, so does the volume of VAT-related transactions. Outsourcing VAT services allows your business to scale efficiently without the need to hire additional staff. The flexibility of VAT outsourcing ensures that your needs are met, whether you’re dealing with a small number of transactions or a high volume during peak periods.

Your internal finance teams often face the brunt of the workload during peak VAT return periods. By outsourcing VAT services, you can relieve your team of this burden, allowing them to focus on other important financial tasks. Outsourcing provides a safety net during stressful times, preventing burnout and helping to maintain productivity across your business.

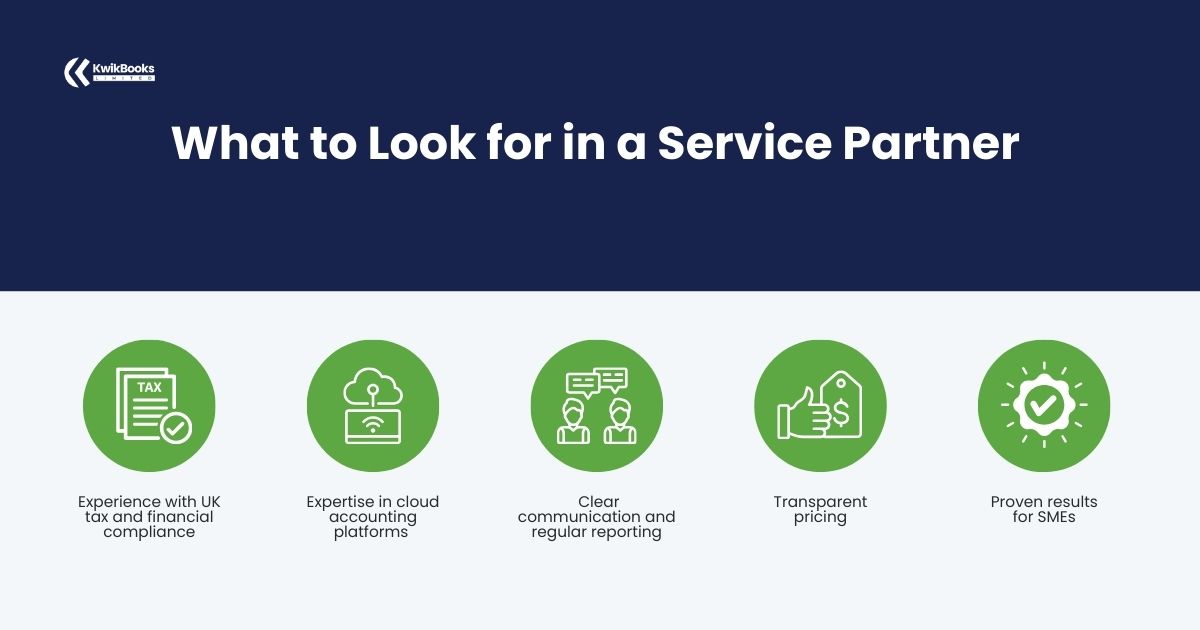

When it comes to outsourcing VAT services, not all providers are created equal. Here are some key factors to consider when choosing a VAT outsourcing service provider:

1. Experience: Look for a provider with a proven track record of handling VAT returns and compliance for businesses of your size.

2. Digital Integration: Choose a provider who uses up-to-date, cloud-based software to ensure seamless integration with your existing systems.

3. Clear Communication: A good service provider will keep you updated on progress and any issues related to your VAT filing.

4. Pricing Transparency: Ensure the provider offers clear and competitive pricing for their services, with no hidden fees.

A good VAT outsourcing provider should integrate smoothly with your internal operations. Data sharing and communication between your business and the service provider should be seamless. This ensures that your VAT records are accurate and up-to-date at all times, without any delays or complications.

Imagine you’re the owner of a growing business, and it’s time for your quarterly VAT return. During this peak period, you’re already stretched thin with customer orders, staff management, and strategic planning. Instead of adding the stress of VAT filing to your already full plate, you’ve chosen to outsource your VAT services to a professional team.

With the professionals handling everything, your team is freed up to focus on core business functions. Your VAT return is filed on time, accurately, and in full compliance with VAT Act 1994. You’ve avoided the typical stress and errors associated with peak-time filing, and you can rest easy knowing that everything is in good hands.

Many small businesses think that VAT outsourcing is only for large corporations. However, VAT outsourcing services are affordable and accessible for businesses of all sizes. Whether you’re a sole trader or a growing SME, outsourcing can help reduce VAT-related stress.

While outsourcing VAT services may involve an initial cost, the savings in time, resources, and avoided penalties make it a worthwhile investment. The benefits far outweigh the expense, especially during busy periods.

While your internal team may be capable of handling VAT returns, outsourcing ensures that the process is faster, more accurate, and fully compliant. This is especially important when the pressure of peak periods is on, and your team is already juggling many tasks.

Filing VAT returns during peak times doesn’t have to be stressful. With VAT outsourcing, your business can reduce the burden of VAT filing, ensure compliance with VAT Act 1994, and avoid penalties. Outsourcing VAT services offers significant benefits, from expert knowledge to time savings, giving you the freedom to focus on what matters most—growing your business.

If you’re looking for a reliable partner to manage your VAT returns, KwikBooks is here to help you navigate the complexities of VAT with ease and confidence.

Most businesses need to file VAT returns quarterly, although some smaller businesses may be eligible for annual filing.

Yes! Outsourcing VAT accounting is a smart solution for businesses of all sizes, particularly small businesses that may lack the resources to manage VAT filing in-house.

Outsourced VAT involves hiring an external provider to handle VAT filing, while in-house accounting means your internal team handles VAT returns.

Absolutely! VAT outsourcing services ensure your business is compliant with the Making Tax Digital requirements, using compatible software to submit your returns.

It’s best to engage VAT outsourcing support well in advance of peak times, ensuring you have enough time to integrate the process smoothly into your operations.

Stay updated with expert bookkeeping tips and insights! Subscribe now to receive updates directly in your inbox for your business.

* We never spam your email

KwikBooks Limited 1 Hadley Court, 223 Ballards Lane, London, N3 1NB,

Monday - Friday 09:30 AM - 05:30 PM

© 2026 All Rights Reserved.