Small businesses in UK often face significant challenges managing payroll and bookkeeping. The time and effort required to stay compliant with tax laws, handle staff payments, and maintain accurate records can pull focus away from growth.

Outsourcing these financial tasks is more than a convenience. It is a smart, scalable solution that helps business owners simplify operations and focus on what they do best. With a trusted partner like KwikBooks, companies gain clarity, efficiency, and confidence in their finances.

Outsourcing payroll means handing over payroll tasks to a third-party specialist who handles everything from salary calculation to HMRC filings. Tasks typically include processing gross pay, managing tax and pension deductions, issuing payslips, and ensuring full compliance with employment laws.

Unlike in-house payroll or DIY software, outsourcing removes complexity, reduces payroll mistakes, and shifts responsibility to professionals. This approach has become increasingly popular among UK startups and SMEs looking for time savings and expertise.

Handling payroll internally demands attention to every detail, from pay rates to deductions. Outsourcing this function reduces admin workload and frees time to concentrate on business priorities.

Hiring in-house payroll staff or managing payroll manually can be expensive. Outsourcing eliminates overheads like training, software, and staff costs, offering predictable pricing.

UK payroll laws are complex and frequently updated. Payroll outsourcing ensures accurate deductions and timely submissions to HMRC, helping avoid costly penalties.

Access expert support without adding permanent staff. Payroll professionals bring specialised knowledge that helps businesses navigate regulations and optimise their processes.

As businesses grow, payroll gets more complicated. Outsourcing scales with your needs, whether you hire more staff or adjust pay structures.

Professional payroll providers manage compliance, reduce errors, and assume responsibility for correct filings and employee payments.

Outsourcing payroll suits many small businesses, especially startups and SMEs with limited HR capacity. It is ideal for companies wanting to save time and ensure compliance without hiring internally.

However, very small businesses with only one or two employees might manage with simple software. Key considerations include payroll complexity, headcount, regulatory obligations, and internal capacity.

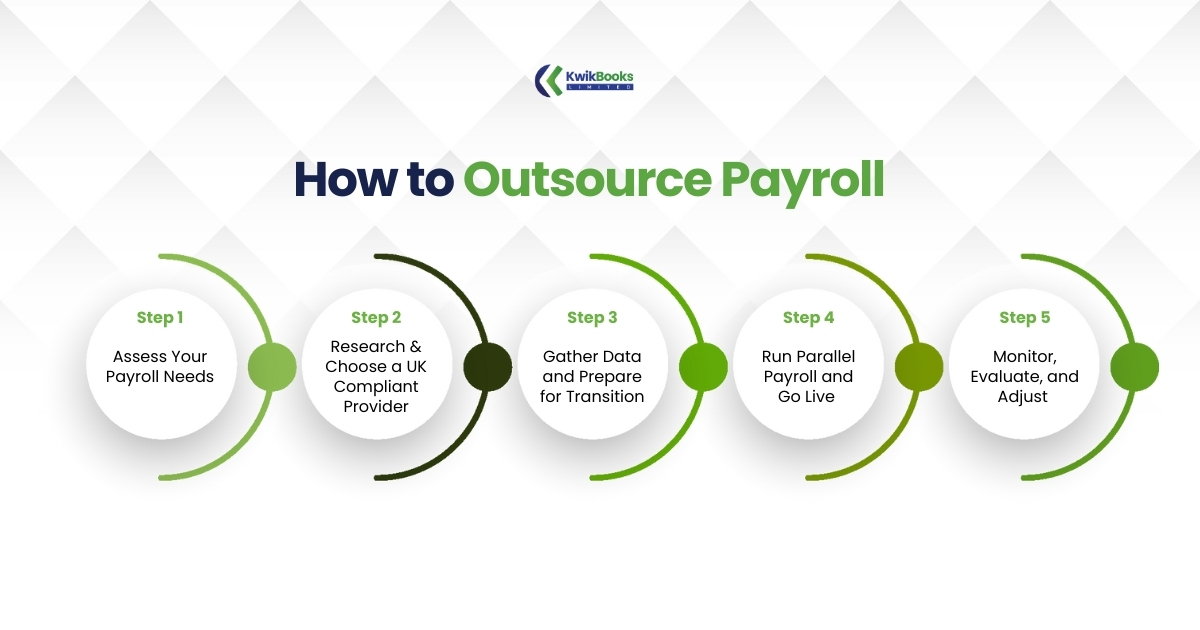

Evaluate your current setup: number of employees, pay structures, pension contributions, and compliance workload.

Look for a reputable provider with experience in UK payroll legislation. Ensure they offer support, flexibility, and data security.

Collect accurate employee data, including tax codes, salaries, and pension details. Clean data makes the transition smoother.

Test the outsourced payroll alongside your current system to identify discrepancies before fully switching.

Regularly review payroll reports and maintain open communication with your provider. Make necessary adjustments as your business evolves.

While the benefits are strong, outsourcing does come with some risks. These include reduced control over processes, data privacy concerns, and reliance on provider performance.

Choosing a trustworthy provider, setting clear service agreements, and maintaining oversight can help mitigate these risks and ensure success.

Minimise risks by selecting providers with robust security measures and transparent pricing. Look for UK compliance expertise and make sure they provide ongoing support and communication.

Maintain some internal oversight and keep one person responsible for payroll coordination. This creates balance between outsourcing benefits and business control.

Combining payroll and bookkeeping with one provider creates a single source of truth. It improves financial visibility and eliminates data duplication.

This unified approach means payroll expenses are automatically reflected in financial records, making reports more accurate and decision-making easier.

Full-service partners manage payroll processing, HMRC submissions, pensions, bookkeeping, expense tracking, reconciliations, VAT returns, and more. They provide complete oversight of business finances.

KwikBooks is a UK-based outsourcing partner dedicated to helping small businesses thrive. Their services include payroll management, bookkeeping, VAT returns, accounts payable and receivable, reconciliations, fixed asset tracking, management reports, and cloud accounting setup.

Working with KwikBooks means you have one trusted team overseeing all financial functions. This simplifies operations, ensures accuracy, and supports compliance with UK regulations.

Combining payroll and bookkeeping is ideal for businesses with limited internal resources. It is also valuable for companies scaling quickly or needing integrated financial reports for better insights.

By bundling both services with KwikBooks, you improve cash flow management, reduce admin costs, and build a finance function ready for future growth.

Outsourcing payroll helps small businesses reduce costs, save time, and ensure accuracy while staying compliant with all UK regulations. Combining payroll with bookkeeping provides unified financial visibility, eliminates duplication, and strengthens decision-making for growing businesses with limited internal resources. KwikBooks offers expert support in payroll, bookkeeping, VAT, and reporting, tailored specifically to meet the needs of UK-based SMEs. Their integrated services ensure real-time accuracy, improved cash flow management, and complete compliance without the need for internal finance staff. With KwikBooks, you get reliable, scalable solutions that adapt as your business grows and financial complexity increases over time. Partnering with KwikBooks allows business owners to focus on growth, while experienced professionals handle every critical financial function efficiently.

Stay updated with expert bookkeeping tips and insights! Subscribe now to receive updates directly in your inbox for your business.

* We never spam your email

KwikBooks Limited 1 Hadley Court, 223 Ballards Lane, London, N3 1NB,

Monday - Friday 09:30 AM - 05:30 PM

© 2026 All Rights Reserved.