It’s a familiar story for many small businesses that are generating sales and growing their customer base, yet still struggling to keep their business financially afloat. Why? The answer often lies in one overlooked factor: cash flow.

Cash flow – the movement of money in and out of your business, is the silent killer of many otherwise successful ventures. But here’s the good news: it doesn’t have to be. With expert bookkeeping and intentional cash flow management, small business owners can unlock clarity, control, and confidence in their finances.

In this blog, we’ll walk you through:

Let’s dive in.

Cash flow refers to the actual movement of money in and out of your business. Think of it as your business’s heartbeat; money comes in through sales or funding and goes out through expenses like rent, wages, and suppliers.

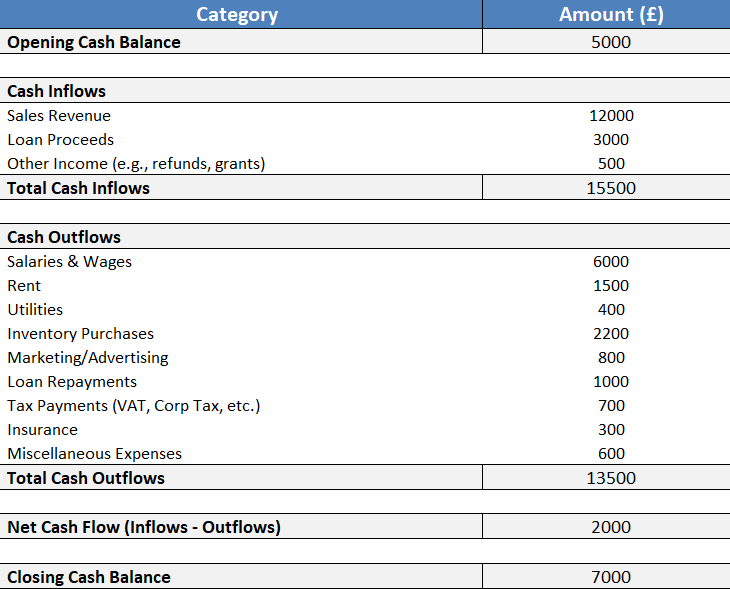

Formula: Cash Inflows – Cash Outflows = Net Cash Flow

It’s possible for a business to be profitable yet still have poor cash flow, especially if invoices go unpaid or spending is unchecked.

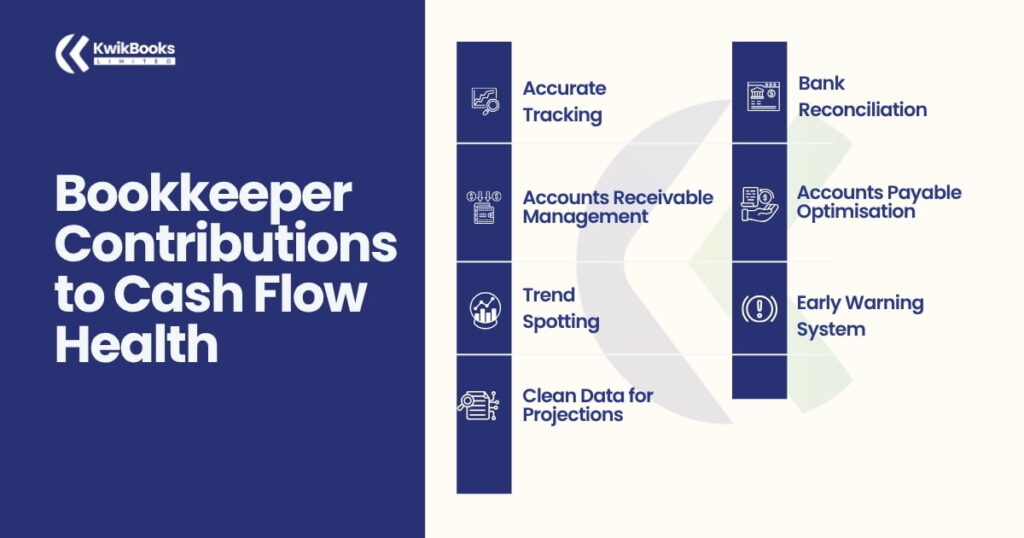

A great bookkeeper doesn’t just record data; they give meaning to your numbers and show you how to act on them. Here’s how:

Your bookkeeper is not a cost centre, they’re your first line of defence in ensuring your business stays afloat.

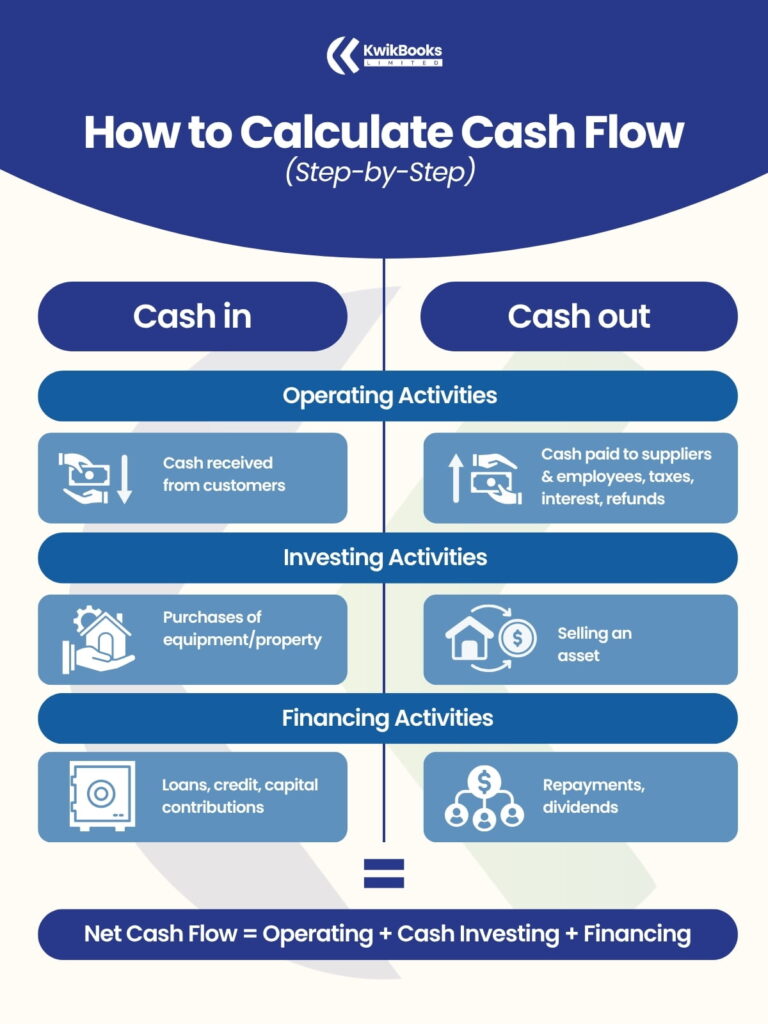

A cash flow statement is a financial report showing how cash enters and exits your business over a specific time. Unlike profit and loss reports, it reflects actual money movement, your business’s liquidity and ability to operate.

Let’s break down the process:

Net Cash Flow = Operating Cash + Investing Cash + Financing Cash

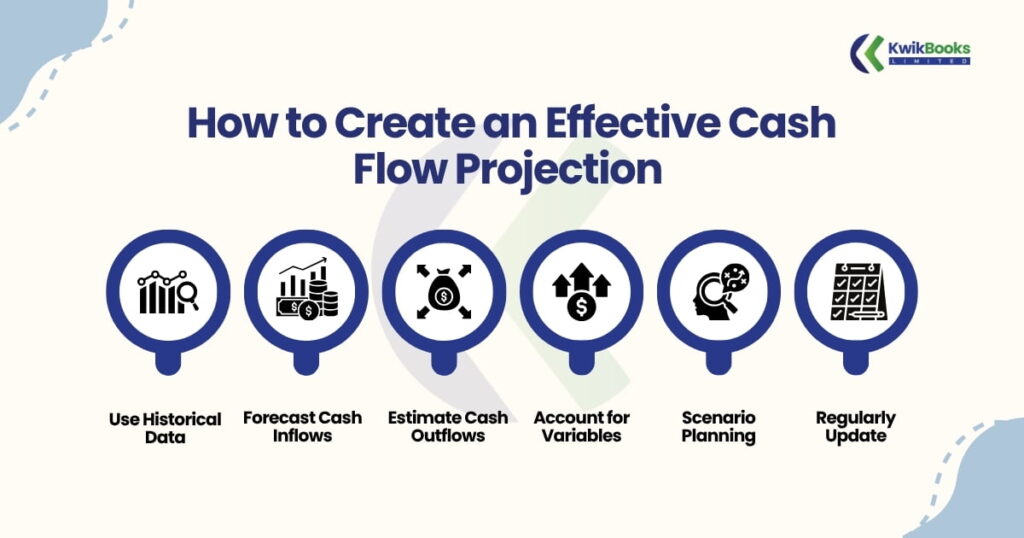

A cash flow projection estimates future inflows and outflows over a set period (e.g., next 3, 6, or 12 months). This tool enables forward-looking financial planning, spotting potential shortfalls before they affect operations.

A projection keeps your small business future-ready. It’s not about predicting perfectly, it’s about staying informed.

With KwikBooks, your cash flow analysis becomes a strategic advantage.

Stay updated with expert bookkeeping tips and insights! Subscribe now to receive updates directly in your inbox for your business.

* We never spam your email

KwikBooks Limited 1 Hadley Court, 223 Ballards Lane, London, N3 1NB,

Monday - Friday 09:30 AM - 05:30 PM

© 2026 All Rights Reserved.